Reflecting the market optimism that was evident prior to the outbreak of the Covid-19 virus, investment transaction volumes for Q1 held up remarkably well in relative terms. However, investment activity was almost exclusively confined to the previous year. In the absence of meaningful transactional evidence illustrating pricing in the post-lockdown environment, valuers were forced to attribute changes to property values based on prevailing occupational and investor sentiment, including considering early data on rent collection.

We have already seen early reaction within our industry, but the full implications – both positive and negative – are likely to be longer lasting. As the severity of the virus became apparent, culminating in its classification by the World Health Organisation as a “global pandemic” on 11 March, independent property valuers faced an unprecedented set of circumstances on which to base judgment, and were able to attach less weight to prior market evidence for comparison purposes to inform opinions of value. This view, sanctioned in a Royal Institute of Chartered Surveyors (RICS) guidance note on 19 March 20201, led to the industry-wide adoption of a “market uncertainty” clause which effectively limited the certainty on the valuations provided and was to have immediate ramifications for fund pricing and, hence, dealing.

All of which meant on 18 March 2020 Columbia Threadneedle issued a notice of temporary dealing suspension, meaning investors are temporarily unable to buy or sell shares in the Threadneedle UK Property Authorised Investment Fund (TUKPAIF) or Threadneedle UK Property Authorised Trust, its Feeder Fund. The suspension is consistent with the FCA’s upcoming rules which require a fund to suspend if more than 20% of its assets cannot be accurately valued. The TUK-PAIF’s independent property valuer, CBRE, deployed the aforementioned “market uncertainty clause” as it was unable to provide an accurate valuation of the TUK PAIF’s assets in the current exceptional market environment – an approach that is consistent with that of the broader industry. We continue to monitor the situation closely and will formally review this decision every 28 days with our depositary. Such a review last took place on 19 August.

As UK businesses came under increasing short-term cash flow pressure, many sought to reduce their cost base as a result, including via deferral of rent. As responsible investors in real estate we took the opportunity to engage with our tenants and ensure a measured outcome for all parties, and we supported the government announcement on 23 March that no tenant will face enforcement action as a result of non-payment of rent until the end of September2.

However, the impact on occupiers is not evenly distributed. Given the deliberately diverse nature of the Fund’s occupier base, we have not adopted a “one size fits all approach” and instead are actively managing our tenant base to achieve the right result for our investors and occupiers alike.

Positively, March Quarter (Q2) rent collection on the TUKPAIF reached 83.6% (collected as at 28 August, day 156 excluding deferrals), and June Quarter (Q3) rent collection reached 74.7% (collected as at 28 August, Day 65, excluding deferrals).

Our investment approach has remained consistent through multiple market cycles and has delivered a track record of relative outperformance in challenging macroeconomic conditions such as these. All investment markets are likely to continue to face uncertainty until there is some form of clarity around the pandemic. We believe the Fund continues to be well positioned against this uncertain backdrop owing to the following features:

- TUK PAIF is a major open-ended product with around £1 billion under management, and it benefits from a well-diversified underlying client base.

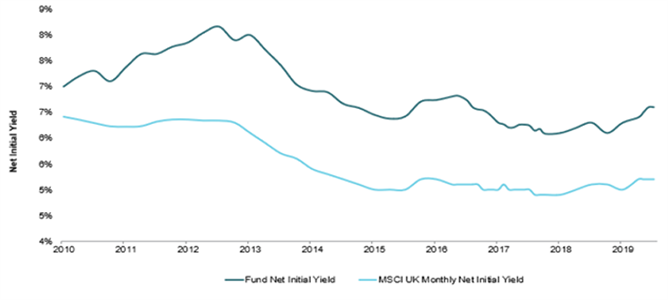

- The Fund offers significant income yield advantage ( Figure 1) of around 100 basis points versus the MSCI benchmark (6.1% vs 5.1%).

- The Fund is highly diversified at investor, tenant (1,072 tenancies) and property (131 properties) level.

- The TUK PIAF is positioned strategically, with a focus on the strongest underlying sub-sectors (35.9% of direct property exposure is to the industrial market).

- There is potential to add value through proactive asset management across the portfolio, despite the potential challenges of a post-Covid-19 occupational market.

- Strong liquidity position of 18.5%3

Columbia Threadneedle Investments, as at 31 July 2020. Past performance is not a guide to future returns

The Fund strategically sold 53 assets in the 12 months to 31 July 2020 generating sales receipts of £310,570,000. Sales were focused on retail assets with 25 sales across the sector. Selective sales were also made across other sectors, for example the sale of part vacant/vacant buildings to mitigate void cost exposure or selling to special purchasers such as tenants or prospective owner occupiers. The sales process assisted the continual efforts to maintain a balanced risk profile within the Fund and to assist in managing liquidity. As a result of this cash increased from 13.1% to 19.5% over 12 months to 31 July 2020.

Over the 12 months to 31 July 2020 the Fund completed 127 lettings and lease renewals, securing rent of £6.8 million per annum, and settled 35 rent reviews achieving an uplift of £0.44 million per annum. Of the 54 potential lease break options over the period just 10 (9.6%) were implemented. The Fund continues to monitor and actively engages with its diverse occupier base in order to achieve the right results for our investors and occupiers alike, regarding current legislation.

Key focus: high street retail, Broad Street, Reading

- Proactive acquisition programme combining 14 retail units to provide a prime island site holding, fronting the pedestrianised Broad Street close to the Oracle Centre and opposite the mixed-use Station Hill redevelopment to the rear. Located around 200m from the recently redeveloped Reading Central Station (Crossrail Terminal).

- High value retail units let to Pret a Manger, Superdrug, Nationwide Building Society, Hotter Shoes, JD Sports and Schuh fronting the busy pedestrianised thoroughfare of Broad Street. JD Sports has completed a new lease to accommodate its expansion into a double unit.

- Pre-planning application proposes extending above by up to 10 storeys, providing approximately 180 residential units. Broad Street will largely remain unchanged, retaining the high-value retail income component.

- The Fund will not engage in speculative development but benefit from latent value released by obtaining planning consent with a view to disposing of all or part of the asset to a developer. Core asset – accounts for 30% of the Fund’s high street retail exposure.

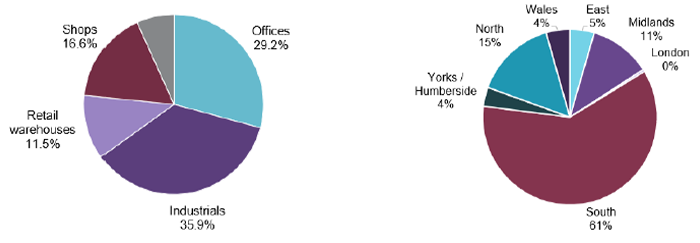

The Fund’s industrial exposure increased from 33.6% (April 2019) to 35.9% in July 2020 via a strategic disposal programme, significantly reducing exposure to the retail sector, and it continues to enjoy a good balance in terms of both sector and regional distribution (Figure 2).

Columbia Threadneedle Investments, as at 31 July 2020.

The fund characteristics described above are internal guidelines (rather than limits and controls). They do not form part of the fund’s objective and policy and are subject to change without notice in the future.

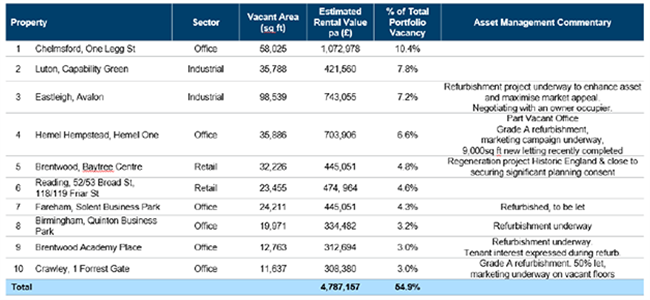

The top 10 vacancies in the TUKPAIF (Figure 3) account for approximately 55% of the total Fund void, with less than 10% attributable to the retail sector. The remainder is attributed to the industrial and regional office markets where the fund has experienced buoyant occupational demand since relaxation of the government-imposed lockdown, particularly in the industrial sector.

Figure 3: TUK PAIF vacancy attribution

Columbia Threadneedle Investments, as at 31 July 2020.

The UK response to Covid-19 is still evolving, and the medium-term impacts on our asset class are only starting to come into focus. However, some trends are becoming apparent and there is no doubt the virus has accelerated existing trends, with significant differences between sub-sectors, and between different parts of some sub-sectors.

Retail provides the clearest indication of this trend: anecdotal evidence suggests retail footfall was down around 80% during lockdown. However, within the sector the impact has not been evenly distributed. Retailers selling goods deemed essential have remained open for business, including supermarkets and pharmacies. A number of the “discounters”, including B&M, The Range, Home Bargains and Dunelm, also fall into this category and have continued trading, while DIY stores remained open for click and collect services.

However, shopping centres and fashion parks almost exclusively closed their doors, with obvious cash flow ramifications for those retailers – although clearly that cashflow burden has eased as doors re-opened with strict circulation and social distancing measures. With unemployment already increasing and spending habits changed by necessity as a result of the lockdown, it is unlikely consumers will return to the high street in sufficient numbers to prevent more businesses following the likes of Laura Ashley or Debenhams into administration. This environment highlights the value of stock picking investments based on tenant-by-tenant due diligence, which ensures assets generate sufficient revenues for occupiers to allow them to trade profitably and continue to pay rent. In other sectors, logistics will continue to benefit from the structural change in the way we shop and has undoubtedly been boosted by a population confined to their online shopping accounts5.

But the virus will also make us question the solidity of in-vogue sectors, most obviously the “alternatives” sector. Cinemas, restaurants, hotels and student housing have all been adversely affected by restrictions on social interaction. Operators saddled with high levels of corporate debt may require collaboration with lenders to survive reductions in revenue, but this in turn will allow the stronger operators to thrive. More generally, operational assets such as student housing, where investors are more closely aligned to the underlying income profiles generated by buildings, will feel immediate pain as management agreements do not offer the same protection as leases. This is not to say that the long-term demographic trends favouring these sectors will reverse, but we are reminded to properly consider the merits of each opportunity on an asset-by-asset basis.