Will the pandemic lead to a re-think on financial priorities and planning?

Covid-19 has dramatically altered the financial and emotional landscape for many people in the UK, at least in the near term. Recent research by Columbia Threadneedle Investments investigates the level of financial resilience in the face of this crisis. Our findings show the negative impact of the immediate financial shock but also reveal some reasons to be optimistic. While many regret their past financial decision-making, to what extent will current events lead to a re-think when it comes to how we navigate our financial future, including greater emphasis on individual financial planning and professional advice?

The following findings come from a nationally representative survey of 800 UK adults conducted in May 2020.

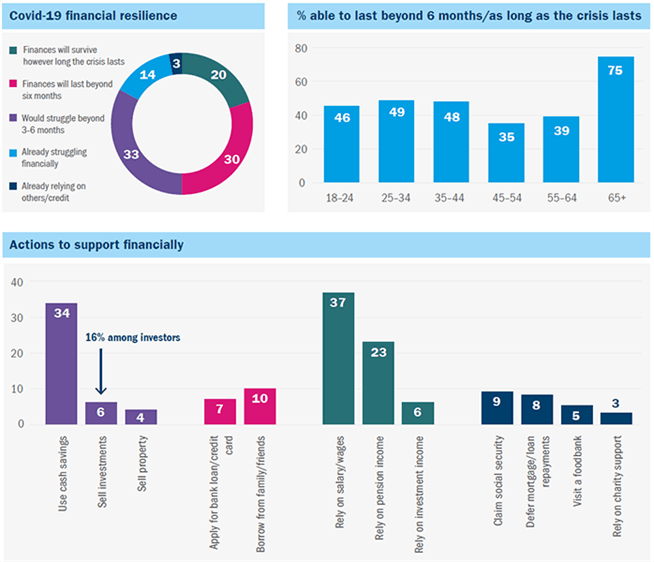

Lack of financial resilience bites back

Half of UK consumers feel their finances won’t last beyond six months in the current lockdown situation. Given the remaining uncertainty regarding the path back to “business as usual”, this leaves huge swathes of people at risk. Those aged between 45-54 and 55-64 appear hardest hit, with only 36% and 39% respectively believing their finances can cope beyond six months, compared to 78% of those aged 65+.

As a result, a significant minority of people are already taking, or expect to take the following actions to support themselves financially during the Covid-19 crisis:

- deplete assets (44%)

- take on additional borrowing (17%)

- visit a foodbank or rely on charity support (8%).

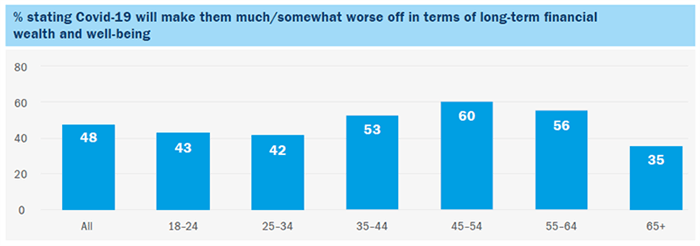

The squeezed middle fear longer-term impact

As the immediate crisis passes, attention will move to longer term horizons. Nearly half of all people (48%) feel that Covid-19 will leave their long-term wealth and well-being in a poorer state than would otherwise have been the case, rising to 51% for those with investments. Again, it is the 45-64 age group that are most likely to feel they will be worse off, perhaps reflecting the shorter period for finances to recover before retirement. A significant minority of people expect Covid-19 to have long-term negative impacts across income levels (29%), investment performance (30%), financial goals eg retirement plans (27%) and career prospects (20%).

The fear of longer-term negative impacts is lower among the 65+ age group, reflecting the relative stability and fixed nature of their income (eg a state pension and/or annuity income).

Investor reaction – fight or flight?

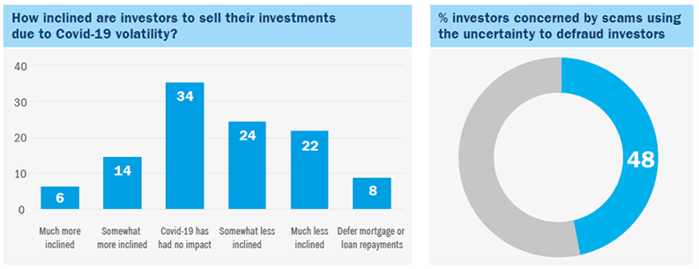

Investing is a long game. As previous crises have shown, short and medium-term shocks do ultimately rebound, and investment markets recover over time. Even so, shocks such as we have experienced during the Covid-19 crisis undoubtedly cause fear and stress and can lead to panic and short-term decision making. One in five investors say they feel more inclined to sell their investments in light of current volatility, with 16% having or expecting to use cash from the sale of investments to support themselves financially during the crisis.

This “flight” mindset also puts investors at risk of scams and fraud, with the Financial Conduct Authority warning of the sudden rise in scams post-Covid. Nearly half of investors are concerned by scams that play on current uncertainty to defraud people.

Uncertainty in the eye of the storm

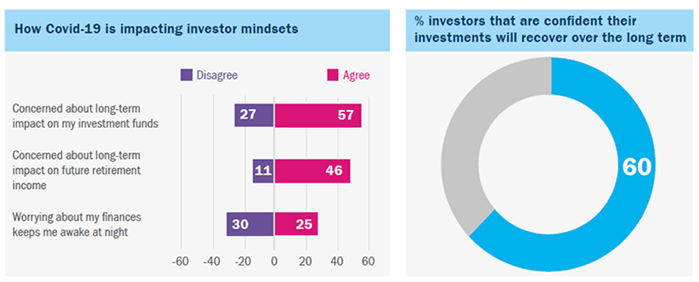

As we are living through the eye of the Covid-19 storm, there is a high level of concern about the financial impact with 57% investors worried about the long-term impact on their investment funds and 46% worried about the impact on their future retirement income. A quarter of investors say worrying about their finances is keeping them awake at night.

There is, however, evidence of investors remaining steadfast, with three in five confident that their investments will recover over the long term.

Will Covid-19 trigger a re-think on money priorities and planning?

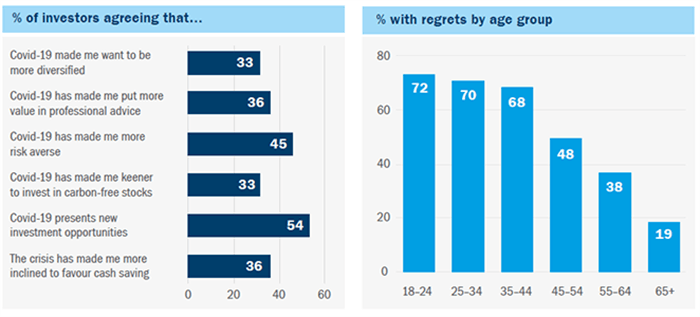

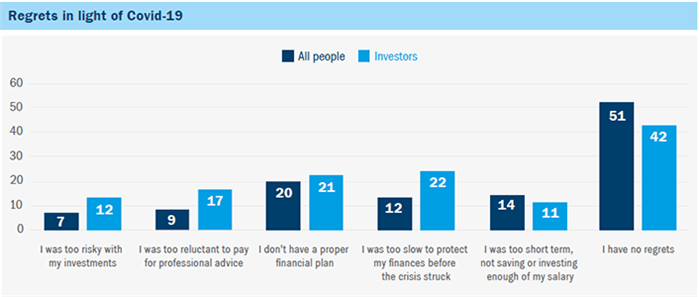

The financial vulnerability many UK households are currently experiencing is causing people to question past approaches and consider the need to do things differently in the future. Half (49%) of people hold regrets about the way they organised their finances before the crisis. Younger people are far more likely to regret their previous arrangements – as many as 72% among 18-24 year olds, falling to 19% among the 65+ group. For younger people, there is the time to act now to ensure a more secure financial future – but what might that look like?

One-in-five people regret not having a proper financial plan, while around one-in-seven (14%) regret being too short term in their approach to their finances.

Among investors, 54% believe Covid-19 presents new investment opportunities, 36% now place more value in professional advice and a third want to be more diversified. However, for 45% of investors Covid-19 has made them more risk averse and for 36% it has made them feel more inclined to favour cash saving. For a third of investors Covid-19 has increased their focus on responsible investing, saying it has made them keener to invest in carbonfree stocks.