As the virus outbreak spreads well beyond China, it is hard to forecast exactly what the economic impact will be, but it’s safe to say that consumption and supply will be significantly affected

The coronavirus is a clear shock to the world economy. In its nature the disease is very different from the likes of SARS and swine flu in that the transmission rate is far higher and mercifully the death rate is much lower. The other clear difference is that the infection has now clearly left Asia. Up until the weekend Europeans and people in the US could be comfortable that this was a China issue with selective outbreaks in the rest of Asia. Now, with the developments in Korea and most critically in Italy over the weekend, this comfortable view of markets has been shattered with the S&P close to 7% off its highs of only five sessions ago1.

Where do we think the coronavirus will develop? Being a non-medical and non-public health person it is very difficult to forecast. I find it hard to believe we will not have a more significant number of cases. The fact there have been school holidays throughout Europe, with many families vacationing across the continent, just exacerbates this. So, the question is how successful the authorities will be at containing any outbreak.

I am encouraged at the success of Singapore in limiting cases and experiencing no deaths. Of course, as we look ahead, we think the coronavirus outbreak will die away – the heat of summer should bring a relief in transmission rates, but even before then successful containment should see the disease incidence taper. Looking at Chinese statistics (assuming their accuracy) we can already see the aggressive containment strategy producing results. There will be a time when this crisis is over, and it should be in the coming months.

The second element is supply disruption, where we are seeing clear evidence of critical component shortages leading to underproduction. Apple already confessed to this last week3, and we will hear much more. Again, if inventory is unavailable it will miss consumer demand and a portion will ultimately be lost. In some industries where inventory cycles are the norm, we will enter a period of inventory adjustment. The depth of the down cycle and how global this event becomes will determine the required period of adjustment. It looks likely that we could have another “industrial recession” driven by the coronavirus, similar to the 2012 euro crisis, the 2014-15 oil price collapse, and the 2018-19 trade dispute-driven slowdown. None of these events triggered an overall recession and given the temporary nature of the coronavirus event we would not anticipate one this time – though in the case of Japan and perhaps Germany we might see one, albeit mild.

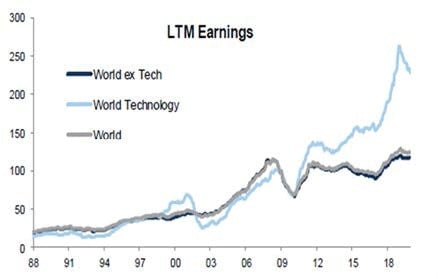

Another way of thinking about this is that the slow growth environment the world economy has experienced since the global financial crisis (GFC) will continue. During that period the average company has struggled to grow earnings. Figure 1, for example, shows the development of global earnings relative to the tech sector over that period.

Figure 1: Companies last 12 months earning (1988-2019)

Source: Goldman Sachs, December 2019.

In the medium term one of the clear implications that coronavirus brings is further pressure to diversify or even shorten supply chains. For the past 30 years the successful model for a western business has been to lengthen supply chains to access cheaper inputs in low wage economies, of which China has been the poster child. President Trump has provided political resistance to this; coronavirus adds a focus on security of supply.

Over the next decade as the use of artificial intelligence increases, the frequency with which companies make, for example, demand forecasts will rise, and the way businesses will take advantage of these insights is with a shorter, more agile supply chain with automation helping to offset the resultant cost pressures.

Finally, while the above discussion provides a framework for thinking about the impact of coronavirus, it is a fast-changing situation. I hope you all stay safe.