Travelling down the US west coast we met 25 companies in five days. Learn more about the tech and healthcare businesses shaping our future.

Our west coast US research trip kicked off with a day in Seattle, ahead of three days in San Francisco and Silicon Valley, before finishing up over 1700 km to the south in San Diego. With 25 company visits on the agenda the schedule was an intense one. A focus on finding ideas for our responsible and sustainability-orientated portfolios meant that technology and healthcare names comprised the bulk of the companies we met.

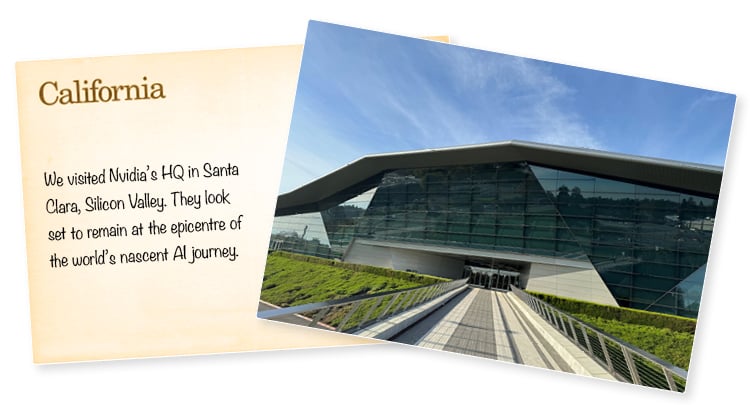

Within the technology space it’ll be of little surprise that artificial intelligence was a recurring theme. We met with giants in the space like Microsoft and Nvidia. These are both widely known and owned businesses but updates from both were – perhaps unsurprisingly – positive. Microsoft’s AI strategy looks set to underpin demand for their Azure cloud services and Nvidia were clear in delivering a convincing message that the firm looks set to remain at the epicentre of the world’s nascent AI journey. From these tech giants down to the mid-smaller names we met on our trip, there was a tangible sense of ambition and to deliver profitable growth for shareholders, without harming the interests of wider stakeholders. One smaller company we visited was Impinj Inc., a Seattle-based semiconductor company, which operates a platform that enables wireless connectivity to everyday items by delivering each item’s identity, location, and authenticity for business and consumer applications. They partner with global consumer brands, such as Decathlon and Uniqlo, who use Impinj’s technology both for rapid, self-serve checkouts, for real-time inventory tracking, and to prevent shoplifting. All vital real-world use cases for our more connected world. Whatever the size of the technology business we saw, we came away with a belief that the future is exciting and it will offer opportunities for those able to identify unmet needs and provide sustainable solutions to them.

Of course, from a sustainability perspective there are clear issues with AI that need addressing but many businesses seem cognisant of the challenges posed by the huge power demands of data centres for example. Indeed, a meeting at Salesforce’s San Francisco headquarters left us in no doubt as to the growing importance of sustainability considerations within many tech businesses. Despite not owning or operating datacentres themselves, Salesforce are fully aware of their energy and water footprint. For them, this means actively engaging with their suppliers around developing carbon neutral services and asking suppliers to set their own science-based targets around net-zero commitments. Another highlight was a meeting with Applied Materials – a leader in equipment, materials, and software for chip manufacture. The firm seems intentional in its approach with an encouraging roadmap planned out on environmental, social and governance (ESG) issues. Operations within the US are now 100% powered by renewable energy sources and the company is committed to reaching this milestone globally by 2030.

The second main cohort of companies we met fell into the healthcare camp. We had a fascinating visit to Dexcom, a world leader in continuous glucose monitoring, which allows people with Type 1 or Type 2 diabetes to manage their condition with accuracy and confidence. Intuitive Surgical was one company we hold that we didn’t get to meet in person but as an existing investor it was exciting to peek at their impressive six building 1.21 million square feet campus in Sunnyvale – a city that lies along California’s historic Highway 101. Tracing its roots back to the 1990s and IPO’ing in 2000, Intuitive Surgical’s da Vinci robotic surgical system was used in 2 million procedures during 2023. And with the firm disciplined and rigorous in its approach to securing regulatory approval for a growing number of specific procedures, its position as a global leader across many geographies looks secure. And they are visibly backing that up with new manufacturing capacity to support the launch of the fifth generation da Vinci system. A meeting with Edwards Lifesciences – a specialist in innovative medical devices – brought our trip to a close. We toured the firm’s campus and visited the manufacturing line for their transcatheter heart valves – impressive pieces of kit that retail at around $34,000. It was great to finish on a high note and we were keen to further explore the potential of this firm with our health care team when back in the office.

Of course, the trip wasn’t all dialogue with company management teams, and we managed to take in some memorable west coast attractions. In Seattle, the Space Needle is best avoided if heights aren’t your thing, but the MoPop museum of popular culture is well worth a visit – especially if you’re a fan of grunge, indie computer games or sci-fi. And at the Chase Centre in San Francisco, we also saw a hard-fought west conference basketball game between the Golden State Warriors and Portland Trail Blazers, with Steph Curry wrapping up the game with a last-second three-pointer.

All in all, you’d have to be very cynical indeed to come away and not be inspired by the creativity and drive that abounds in the successful businesses that call the US west coast home. The fact that so many of them have only sprung up in the past 20-30 years, yet have already become so globally influential, is genuinely impressive. There are also many more to come back and visit, such as AirBnB, Alphabet, Apple, and Crowdstrike. These influential companies are shaping our future and we will keep heading back to visit them to deepen our understanding of their global ambitions. The mention of any specific shares should not be taken as a recommendation to deal.