While political risk, a second Covid-19 wave, lower economic activity and suppressed inflation might trigger a short-term sell-off, in the medium term a high equity risk premium and low rates will support equities

What is indisputably positive is the US Federal Reserve’s new policy framework, with an explicit plan to let inflation overshoot. Even if inflation rises the Fed will look through it. Eventually that will steepen the interest rate yield curve. Yet the biggest determinant of long-term interest rates is the direction of short rates. If short rates are going to be stuck at low levels for the next four to five years, how can long yields go up?

New Covid-19 lifestyle restrictions, together with less fiscal support, will weigh on economies towards the end of the year. At the time of writing the emergency US federal unemployment package has lapsed and a new fiscal package has not been agreed. Taken together, delays in the enactment of such a stimulus and a sell-off in US technology stocks have all heightened the short-term risk in markets, although the vaccine news is hugely welcome.

Watch the equity risk premium

Meanwhile, monetary policy is exceptionally loose. The Fed has promised to keep rates on hold until the economy has reached “maximum employment” and inflation is “on track moderately to exceed 2% for some time”. A majority of the Federal Open Market Committee does not expect to move rates before at least the end of 2023. While bond yields are unlikely to rise in the next few years in the absence of inflation, they are unlikely to fall further given how low they are already. The equity risk premium is high enough that equities can still go higher – even if bond yields rise a little.

Growth versus value

This prolonged period of low interest rates suggests parallels with the “nifty 50” era of the 1960s and 1970s when 50 quality growth stocks dominated US equity market performance.

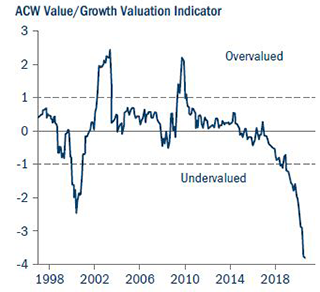

Even so, if bond yields only stabilise rather than go up, this could remove a major headwind for banks. Value stocks are now cheaper versus growth stocks than at any point in history – even cheaper than at the height of the dotcom bubble in 2000 (Figure 1).6 But they need a catalyst to prompt a rebound. A new fiscal deal and a successful, fully approved and rapidly distributed vaccine might provide that, but we are not there with either quite yet. There are a number of vaccine candidates in phase three trials, and three which so far look to be successful – but we still need some time for final approval, manufacturing and global distribution.

Value tends to outperform growth when the US dollar is weakening and global growth accelerating. Growth stocks did well in the late 1990s when the dollar was strong, while value performed better from 2001-07 when the dollar was weak. If the dollar weakens in the coming months, it could help lift all those value names currently in the doldrums.

Figure 1: Value stocks are extremely cheap relative to growth stocks

Source: BCA Research Inc, September 2020. Based on relative price/book, price/earnings and dividend yields/IBES/Thomson Reuters and MSCI Inc.

Support for risk assets

With the US election behind us, vaccines should accelerate recovery. It is unlikely that current policy support will change as authorities want to run economies hot to sustain the recovery. That will push equities higher.

Until now, there has been a lot of uncertainty over long-term growth, which has counterbalanced the positive effects of lower rates. It has also reflected deflationary tail risks and fears about the future of the EU and the euro. Now that we are at the beginning of a new cycle, with moderate growth but low inflation and interest rates, policy support should help to reduce the risk of another recession.