To begin with, supply was the concern, but now demand is at risk. What is without doubt is that recession risks are elevated.

When news of the novel coronavirus first began to emerge from China, economic analysis was generally focused on the disruption of supply chains, and the effect on companies unable to easily relocate manufacturing. Now that companies and consumers are cutting back on spending, the drop in demand has heightened fears of a sharp slowdown in economic growth. A collapse in the price of oil has added to concerns.

The growth outlook dims

Recession risks are now clearly elevated, and we expect there will be a hit to US growth. The extent of the decline in growth will depend on the severity and the duration of the coronavirus infections. If the spread of the virus disrupts demand for a prolonged period – beyond the next two months – the impact on growth will be more significant. Swift and draconian actions have led to containment in some East Asian countries (China/Singapore/Hong Kong), but as is evident from Chinese data, and likely Italian data to come, these measures also take a severe toll on economic growth.

Further headwinds: falling oil prices and capital expenditure

As the experience of 2015-16 has shown, a decline in oil prices is no longer a net positive for the US economy. It may benefit consumer pocketbooks, but at times of uncertainty consumers are likely to save the windfall and not spend. With the sharp fall in oil prices we cannot rule out the risk of credit downgrades and increased defaults among energy companies, which could spill over to other segments of the US economy. Our expectation for capital expenditure (capex) generally, and in energy production specifically, is for deep cuts, perhaps to zero, in 2020 which will also be a drag on growth.

Watching how consumers and businesses react

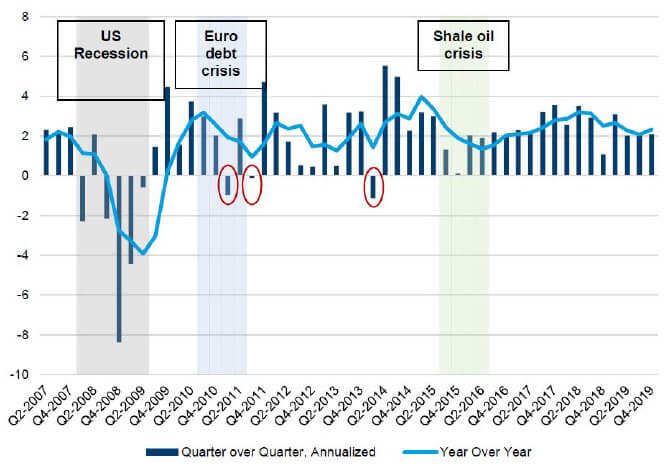

In the current expansion – the longest on record – there have been three instances of negative quarterly growth, and yet the economy has continued its long upward grind.

Figure 1: United States real GDP growth

Source: Macrobond; Bureau of Economic Analysis; Columbia Threadneedle Investments.

If containment and mitigation efforts are successful in the US, we expect the hit to growth from coronavirus to be short lived. In addition to public health efforts, much depends on how businesses and consumers react. US companies will likely see a hit to earnings, but it is not clear how they will respond. Consumers are also likely to be impacted, and we must watch to see if they retrench spending sharply or benefit from lower rates and oil prices. Leading indicators to help assess these responses include the Institute of Supply Management Purchasing Managers’ Index, consumer and business sentiment indicators, and monthly payroll data.

Catalysts for improvement

The most significant catalyst for improvement will be limiting the spread of coronavirus. Monetary and fiscal responses will also be important to ensure that companies can continue to borrow if needed to fund operations:

Monetary policy – It is evident that the US Federal Reserve Board is prepared to act quickly and decisively. The Fed’s activities and forward guidance can help stabilise market sentiment. Cutting rates is less important than keeping the credit channels open; maintaining liquidity in the markets will be essential.

Fiscal policy – A well-thought-out and targeted fiscal response is also needed to support demand in the economy. In the US we have seen an announcement of $8.3 billion in emergency funding from the administration, and more is likely to come. In China we have seen coordinated monetary, fiscal and credit programs.

The bottom line

If coronavirus disrupts demand for a prolonged period – beyond the next two months – the impact on growth will be far more significant. Ongoing economic reports may continue to fuel volatility as investors digest the data, and it will be important for investors to distinguish between backward looking reports (eg, retail sales and payroll) and forward-looking indicators such as sentiment.